Care.com is a website that launched in 2007. It allows customers to book services such as childcare, senior care, tutoring, daycare, housecare, and pet care, but is best known for babysitting. All services are available via their website. Their goal is to provide help to families at each stage of care. They prioritize safety, and conduct a background check for every single one of their care providers. Their care providers must be over the age of 18, and most have some sort of caregiving experience. They provide easy search results of caregivers in your area. They have been the market leader and seem to have deep passion about their company.

Care.com is a part of the healthcare/caregiving industry. According to Care.com $340 billion dollars is annually spent on caregiving. Caregivers can be required for many different ages and reasons. Caregiving is generally a second job for many Americans, and most who are and are in need of a caregiver are adults. Caregivers within the family are considered informal, while caregivers who are getting paid are considered formal. By this definition Care.com would fit into the formal caregiver category. According to Caregiver.org 22% of caregiving workers are middle-aged and 13% are aged between 18 and 29. On average, employed caregivers work 34.7 hours a week. Based on these findings the expected audience I think will be found on social media are working mothers who are aged 25-35. According to a survey from sprout social “60% of Millennials have used social media for customer service, by sending either a private message or posting publicly on a brand’s page” Based on this finding I think they will also be the majority of critics and advocates for Care.com on social media.

The top three fundamental needs in the Healthcare and Caregiving Industry are number one having a trusted provider, ease of scheduling, and the third is the highest quality care. A fourth need will be identified through an analysis of the conversations surrounding the brand/marketplace and will be discussed in the conclusion but I believe it will end up being competitive pricing.

Shortened: I predict that customers who have used Care.com are satisfied with the with the safety and quality service from the caregivers, but have complaints about the ease of scheduling or booking a caregiver. I think the majority of the customers using Care.com will be working mothers looking for babysitters for their children.

From my initial searches the data I will be using from social studio will be based from the past 7 days. I have found that the more days I looked at the less specific the conversation seemed to be about Care.com as the conversation became very broad. The top row has the caregiving industry, competition and Care.com included and the bottom includes only conversation about Care.com.

The top person mentioning the brand on Twitter was the brand itself by quite a bit. The following users were people who had re-tweeted Care.com. The top hashtags used by Care.com were very interesting because they mainly focused on pets, and climate change. Climate change was surprising because it has basically nothing to do with the brand at all.

These are from an initial search of the brand. The largest group of people who are discussing Care.com online are females aged 25-34 followed by 35-44 and the third age group being 65+. The first two are likely parents of young children and the third is likely both male and females who have older parents or spouses who are in need of care. Care.com is a US company based in Austin, TX so it was interesting that their top location was in Massachusetts. There were also people from England, but the rest were from the US.

My initial word cloud was also interesting. There were not a lot of words specifically related to Care.com or the services it offered There were a couple like kids, mom, nanny and sitter. Sitejabber is an online business where people can search for trustworthy businesses that are not scams, so that can either be a good thing or a bad thing that Sitejabber is one of the top words being used in regards to Care.com.

Overall Care.com has a positive sentiment online, but it's only just a little more than half, except for on march 8th where the negative sentiment was slightly higher than the positive.

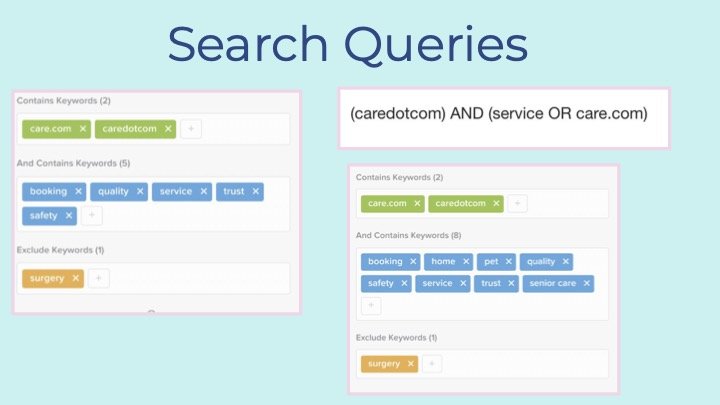

Based on these initial findings I knew that I needed to try and cater my searches and results more towards the fundamental needs, and to try to discover a new one. I first looked on Meltwater and basically any other and word (boolean) besides service did not show me results. On social studio I used Care.com’s username, and also the way most people write it out in a sentence. I also used and words that I though would relate to the three fundamental needs and I also added service into the and search because of my findings from Meltwater. I was also getting a lot of posts about surgery in China so I excluded that word.

My search queries narrowed down the volume of posts a lot, but it did allow me to see actual conversations about Care.com instead of surgeries. The top words being used did not change that much which I found very interesting because I thought they would have changed based on my queries. The positivity sentiment also went down slightly. Before it was 65 and after my search it went down to 63, but after reading through some of the posts I don't think this is accurate because many of the posts seemed more neutral than negative because they used sarcasm.

I found a lot of posts that were unhappy with Care.com’s customer service or their subscription service. They were upset because they wanted to cancel their subscriptions but were not able to contact any customer service help. There were also many people who retweeted Care.com’s tweets. There were also people who had left reviews about how trustworthy the nannies they had found were and they fully trusted them with their children. I did not find really any posts about any of the other services Care.com offered such as pet care, senior care, or tutoring. I have also outlined the sentiment with its matching border color.

These were the top three influences who had either retweeted or tweeted something about Care.com. Reshma Sasaujani was mentioned in a tweet from Care.com.

The top two main competitors for Care.com are Sittercity and Urbansitter which offer similar services, but are more catered to only babysitting services rather than multiple caregiving services.

Sittercity has a lower post volume, but positive higher sentiment than Care.com. The word cloud seems much more focused on the brand and what they do than Care.com’s.

Significantly less post volume than both Care.com and Sittercity, and a seemingly random word cloud, but the sentiment is the highest out of the three, but it may not be extremely accurate as it has the lowest post volume.

I was partially correct in my hypothesis. I was correct in the fact that mainly females who were aged 25-35 would be the main people talking about the brand online. I was also correct about the fact that most of the conversations were surrounding babysitting rather than the other services Care.com offers, but I was wrong about the fact that customers were satisfied with the quality of service as that along with the subscription service prices were the main complaints Care.com’s service, but very minimal was mentioned about the caregiver’s service.